–SBP endorses idea of setting up Bank of Balochistan

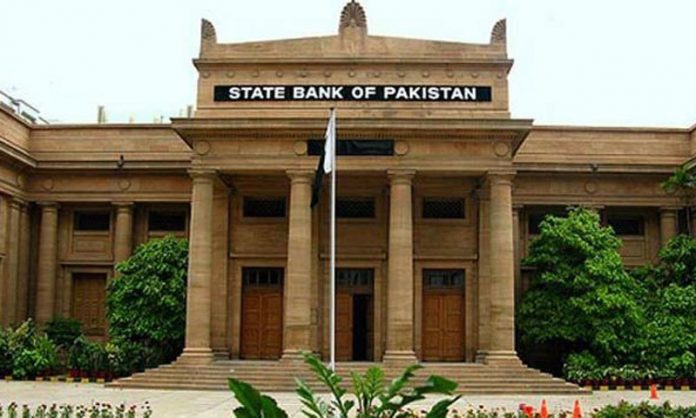

KARACHI: The Agricultural Credit Advisory Committee (ACAC) meeting was held in Quetta, on Friday night, under the chairmanship of State Bank of Pakistan (SBP) Governor Tariq Bajwa.

Bajwa, while congratulating the ACAC members on surpassing the Rs 700 billion targets for the fiscal year 2016-17, stressed upon four key areas requiring special attention of all stakeholders, which included: (a) strategising the achievement of Rs 1 trillion disbursement target; (b) increasing financial inclusion of smallholder farmers to address their credit needs, particularly for production loans; (c) rationalising the markup rates on agricultural financing to pass on the benefit of historically low discount rate; and (d) Increasing bank’s footprint in underserved regions and provinces for reducing regional disparities.

While delivering his keynote address, Bajwa said that in order to successfully harness the untapped potential of agricultural, it is necessary to meet the credit demand. He highlighted critical challenges confronted by the industry, including provision of finance to small and marginalized farmers, addressing geographical and sectoral imbalances and financing of non-crop activities.

In particular, financial institutions need to come up with new ideas and products for spreading their outreach to remote and underserved areas in Balochistan. He also stated that there is a huge scope and demand for Shariah compliant agri-financing products and recommended Islamic banks to increase their focus on Islamic agri-financing.

He also supported the idea of establishing Bank of Balochistan to improve financial services in Balochistan.

The governor highlighted the active role played by the Central Bank for promoting agri-finance in the country. He shared the SBP’s multifaceted approach to sensitize banks to adopt agricultural financing as a viable business line. He informed the audience that due to joint efforts by the SBP and the industry for broadening access to finance in the country, formal credit disbursement by financial institutions has increased to Rs 704.5 billion in FY 16-17 from Rs 391.4 billion in FY 12-13, showing a steep increase of more than 80 per cent in four years.

The key note address was followed by a presentation wherein the performance of banks on key indicators relevant to agricultural financing was reviewed. The participants deliberated on the way forward for credit enhancement in the underserved provinces/regions, especially Balochistan.

The committee proposed the following key actions: Designate at least 20 per cent of total branches as agri-lending branches, and ensuring availability of adequate an agri-credit officer in such outlets; ensure achievement of agri-credit targets of underserved provinces; linking advances with the deposits mobilized from the province to ensure supply of agri-credit; making agri-finance a key indicator of banks’ performance; adoption of automated land record management system; reliance on digital financial services and branchless banking channels; capacity building of bank officials and farmers awareness; and use of service providers to support farmers in pre and post-harvest activities.

While summing up the meeting, Bajwa had shown his confidence in the bank’s commitment to achieving agri-credit target of Rs 1,001 billion for FY 2017-18; increase outreach agriculture borrowers by one million during FY 2017-18; and enhance farmer’s productivity through availability of credit, extension services, farm mechanisation, quality seeds and fertilizers, storage facilities and marketing of agri produce.

In the end, the governor advised the financial institutions to treat agriculture financing as strategic part of their overall credit growth policy and encouraged them to explore new markets; develop innovative products; promote Islamic agri financing and create more linkages for improving livelihoods in the country.

The meeting was attended by senior officers of the SBP, presidents and executives of commercial banks, specialized banks, microfinance banks & Islamic banks, representatives from the federal and provincial governments, and chamber of agriculture/ farmers associations.

In the end, the governor thanked the participants and hoped that the financial institutions will achieve an overall annual target for 2017-18 along with achieving their provincial/regional targets.