This article is a paradox: it will ask you to stop taking expatriates seriously and is itself written by an expat. But with the ruling Pakistan Tehreek-e-Insaf’s (PTI) obsession with Pakistani expatriates as some sort of magic resource that will be the salvation of this country, the following sentence – unfortunately – needs to be stated explicitly: I am not better than you, and the government of Pakistan needs to stop treating me that way.

What are we talking about? The Naya Pakistan Certificates, which are fundamentally a certificate of deposit product accessible only to expatriate Pakistanis through the Roshan Digital accounts (which themselves are a travesty, but more on them later). They offer extraordinarily lucrative interest rates which are unjustifiable considering the state of interest rates everywhere in the world. And they are available only to expatriates and not to anyone who actually lives, works, and pays taxes in Pakistan.

That is right: Pakistanis are going to be treated as second-class citizens in their own country, and it is going to be at the behest of the people who left the country when things got tough. Does that sound remotely fair?

In this article, we explore three things: firstly, what are these deposit accounts and why do they exist at all, and why are they targeted towards expatriates? Second, we explain that the deposit accounts themselves are a terrible idea and a continuation of the same terrible macroeconomic policies of former finance minister Ishaq Dar that caused the 2018 recession, except that these policies are even more poorly executed than Dar’s policies.

And lastly, we then get into the fact that these deposit accounts are just manifestly unfair, offering privileges to expatriate Pakistanis that are denied to resident Pakistanis.

What are the Naya Pakistan Certificates?

The Naya Pakistan Certificates are a modification of a previous attempt to get expatriate Pakistanis to park their money in Pakistani government bonds, but this product – from a purely financial consumer perspective – is actually much better than the previous attempt. The Naya Pakistan Certificates replace the Pakistan Banao Certificates, a program which flopped badly and failed to generate any meaningful amounts of money for the government.

We previously reviewed the Pakistan Banao Certificates – which were US dollar-denominated government of Pakistan bonds – and found that they were not a particularly compelling bond offering relative to the sovereign risk posed by the government of Pakistan. The interest rate was lower than those of comparable dollar-denominated bonds, including ones issued by the government itself.

Well, it seems the government took our advice to heart. They raised the rates – by a lot. The actual nominal rates do not appear to be particularly much higher. The 5-year Pakistan Banao Certificate had offered a US dollar-denominated interest rate of 6.75% compared to the 5-year Naya Pakistan Certificate which offers a rate of 7.0% for the same tenure.

The difference, however, is that the benchmark interest rate against which all US dollar-denominated bonds are measured – the interest rates on comparable US treasury bonds – have shifted dramatically. In February 2019, when the government of Pakistan launched the Pakistan Banao Certificates, a 5-year bond issued by the United States Treasury had a yield-to-maturity (a standardised rate of return for a bond) of approximately 2.5%, according to data from the United States Treasury Department. That implied that the Pakistan Banao Certificates were priced to pay a yield of 4.25% above a US Treasury bond of a comparable yield.

In September 2020, when the government of Pakistan has launched its Naya Pakistan Certificates, the 5-year US Treasury bond had a yield-to-maturity of approximately 0.27% per year. That means that the Naya Pakistan Certificate is paying a yield of 6.73% above a comparable US Treasury bond. That difference in the spread between comparable US bonds and the government of Pakistan’s debt is staggering.

That, in itself, is a red flag.

But then there is the fact that the Naya Pakistan Certificates are not – strictly speaking – bonds, but rather certificates of deposit. More specifically, they are (almost) no-penalty certificates of deposit, meaning there are no penalties for early withdrawal, if one withdraws after the first three months.

That means that the depositors’ assets are more accessible – liquid, in finance parlance – than a typical government bond. Liquidity typically means that investors are willing to pay a higher price, and thus get a lower yield, for a fixed income investment like a certificate of deposit. That is why certificates of deposit typically tend to have lower yields than bonds of similar risk and tenor.

So, the Naya Pakistan Certificates should have had considerably lower interest rates than they do.

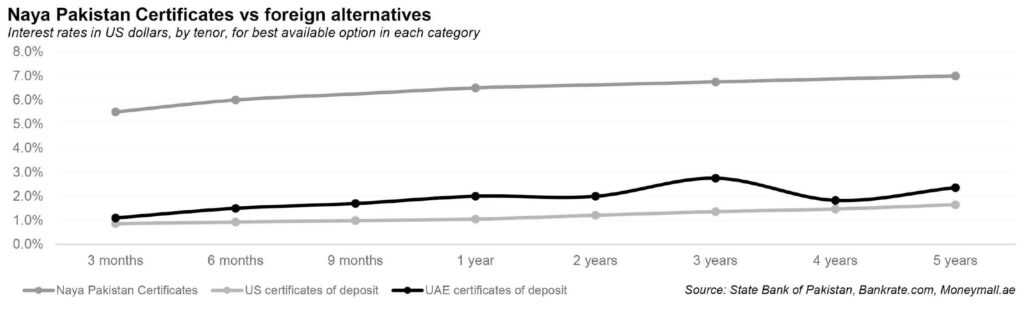

Of course, the flipside is also true: from a depositor’s perspective, these are a really great product. Profit compared the rates offered on the Naya Pakistan Certificates to US dollar-denominated certificates of deposit in the United States and the United Arab Emirates (two markets for which it is easiest to compile such data) and found that the rates are significantly higher than rates in both countries.

The best rate we could find for a 5-year certificate of deposit in the United States was 1.65% offered by Old Dominion Bank, compared to the 7% for the Naya Pakistan Certificate. And in the UAE, the best 5-year rate we could find was 2.36%, offered by the National Bank of Abu Dhabi. In other words, it is not even close. The Naya Pakistan Certificates are a far better product if you are an expatriate Pakistani.

So why is the government offering such high rates to expatriate Pakistanis? To help the country raise its foreign exchange reserves and help the government finance its deficit. Those sound like reasonable goals, but a closer examination suggests they may end up leaving the economy weaker rather than stronger.

Why the Naya Pakistan Certificates are a terrible idea

The fundamental problem is that the government of Pakistan is raising financing at rates akin to a distressed debt investment, which only makes sense to investors when the entity raising that debt promises to fix the structural problems that got it into that distressed financial situation in the first place.

On that front, the government of Pakistan is making no serious efforts at all. If anything, the Naya Pakistan Certificates may be proof that the government has not gotten out of some of its very bad habits.

Let us take a step back and first examine what will happen with these Naya Pakistan Certificates. These are certificates of deposit backed by loans to the government of Pakistan. The government of Pakistan has not stated explicitly whether these loans will be for a specific purpose, so a good assumption is that these bonds are likely general purpose bonds, meaning they will be used to finance the government’s budget deficit rather than any specific projects.

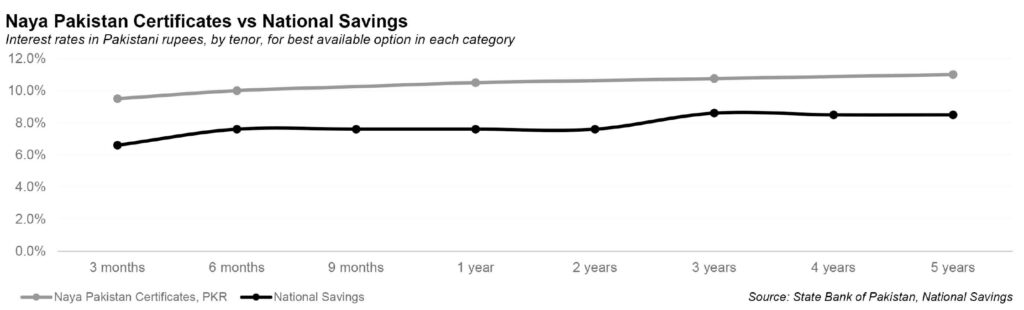

Here is what that means: the government is borrowing at high interest rates in US dollars to pay for mostly consumption expenses that it has undertaken in rupees. It will then have to pay back these loans at a time when the rupee will have likely depreciated, meaning the effective rupee interest rate on these loans is quite high and actually higher than the rates the government is able to borrow at when it borrows domestically in rupees from resident Pakistani individuals and institutional investors.

Indeed, we lay out in one of the charts the comparison between the rates the government borrows from savers at the National Savings – which are quite comparable to rates the government pays institutional investors when it sells Pakistan Investment Bonds (PIBs) – and the rupee-denominated rates of the Naya Pakistan Certificates. The Naya Pakistan Certificates, as is evident in the chart, are clearly higher.

And by the way, the government’s rupee-denominated rates for the Naya Pakistan Certificates assume an annualised rupee depreciation rate of 4%, when in fact, the historical average has been between 6% and 7% a year, depending on which time period one examines. Since 1992, the rupee has depreciated by an average of 6.7% per year.

So, the effective interest rate the government is paying on the Naya Pakistan Certificates is much higher than it would otherwise from any other borrowing source. Is there something else that makes it worth it for the government to pay this high a price?

The government’s argument would be that it helps build up foreign exchange reserves. Every time an expatriate Pakistani opens up a Roshan Digital account and deposits money into it, they do so in US dollars, which then become part of the country’s foreign exchange reserves. That helps the current account deficit and helps keep the exchange rate stable.

But the problem with doing that is that this is all borrowed money, and – in the case of certificates of deposit – can leave any time it wants to, which usually coincides with an economic downturn in Pakistan.

Contrary to popular belief, Pakistan does not turn to the International Monetary Fund (IMF) for bailouts every few years because it has a balance of payments crisis and runs out of dollars. The government runs out of dollars and has a balance of payments crisis because it borrows in dollars to finance consumption rather than investments that would yield more foreign currency.

The government’s actions are akin to a company borrowing lots of money to pay its CEO and management tons of bonuses, instead of – for example – investing in a new factory or a new line of business that would generate the additional cash needed to pay the loan back.

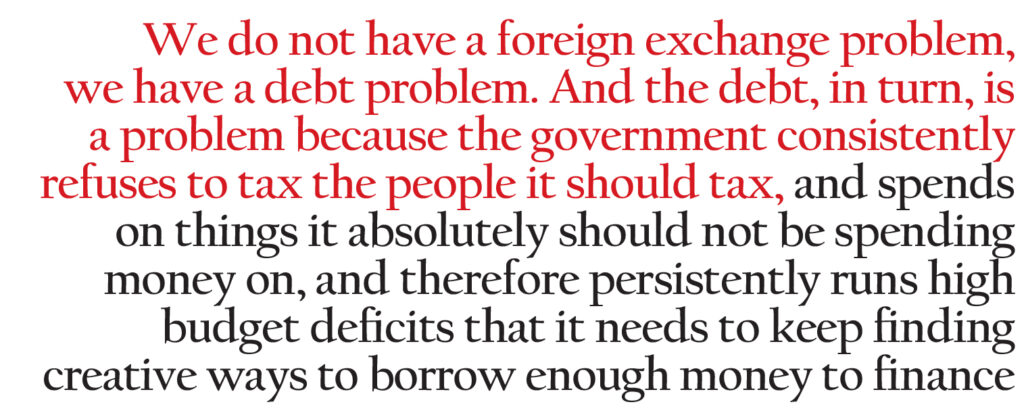

We do not have a foreign exchange problem, we have a debt problem. And the debt, in turn, is a problem because the government consistently refuses to tax the people it should tax, and spends on things it absolutely should not be spending money on, and therefore persistently runs high budget deficits that it needs to keep finding creative ways to borrow enough money to finance.

Here is the fundamental structural problem with the Pakistani economy that keeps on causing the fiscal and current account crises that we keep facing:

- The government makes no effort to tax the wealthy, both the urban industrial elite and the rural agricultural elite.

- It buys the upper middle class’ silence by offering highly subsidized energy costs.

- It buys off the organized labour unions by maintaining large, inefficient state-owned enterprises to employ them.

- It ignores absolutely everyone else.

More foreign exchange – whether it be through government bonds or any other means – is not going to solve that vicious cycle.

The Pakistan Banao Certificates – and now the Naya Pakistan Certificates – are the latest in a long line of schemes designed to get the government more money without taxation. The government of Pakistan, in other words, is effectively a Ponzi scheme and investors in the Naya Pakistan Certificates will be only marginally better off than those of Bernie Madoff.

Indeed, in some ways, this is actually a less efficient way to raise funds than former Finance Minister Ishaq Dar, who continued to borrow US dollars to keep the price of the rupee artificially inflated but did so through institutional bonds which had a lower interest rate than the ones being offered by the Naya Pakistan Certificates. And with sovereign bonds, underwritten by global investment banks, there is at least some measure of certainty that you will raise the amount of money you want to.

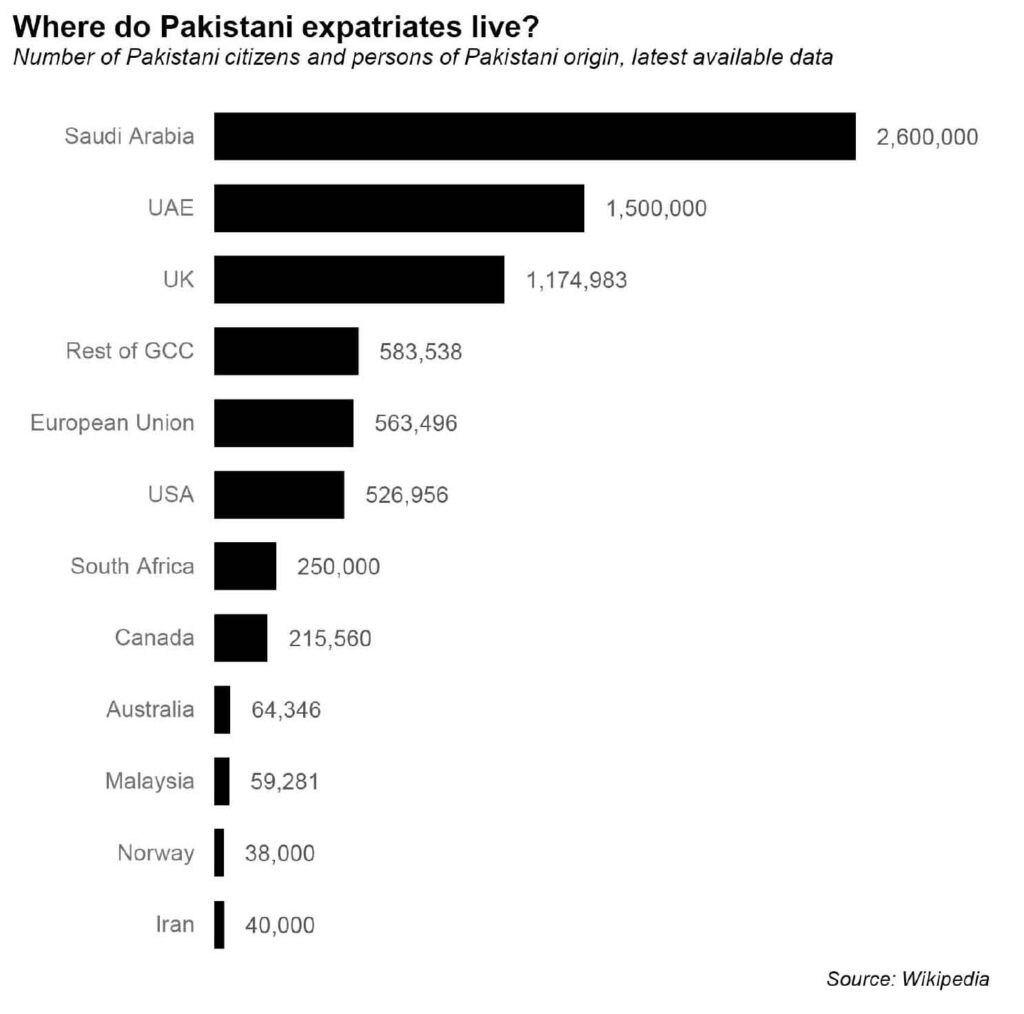

With certificates of deposit like this, who knows how much will be invested? Profit has learned from some high net-worth individuals based in the United Arab Emirates that they are considering investing relatively large sums of money, but it remains unclear exactly how representative those individuals are of the broader Pakistani expatriate community, whether it be in the UAE or elsewhere. Sources from within the banking sector confirm that banks like HBL, Faysal Bank and others are aggressively opening up Roshan Digital accounts at their branches, and an estimated ten thousand applications are already under process.

In short, the Imran Khan administration appears to have revived the old government obsession with the exchange rate – after having spent two years being so good about letting it be free – and are less efficient at trying to prop it up than the Nawaz Administration. At least that lack of efficiency is likely to be some small measure of mercy for the long-suffering Pakistani economy.

Why the Naya Pakistan Certificates are unfair

But beyond the fact that the Naya Pakistan Certificates are a likely less competent way of implementing a bad policy objective, there is a more fundamental problem with them: they are unfairly generous to expatriate Pakistan and, by implication, render resident Pakistanis second-class citizens in their own country.

This obsession with expatriate Pakistanis is one that is unique to the Imran Khan Administration and their ideological predecessors in the Musharraf Administration.

But at least in the Musharraf Administration, the only thing that the government did was make it easier to have dual citizenship and to enter and exit the country by possessing a Pakistan Origin Card (POC) or a National Identity Card for Overseas Pakistanis (NICOP). Those are just procedural and bureaucratic accommodations for people that help keep the diaspora connected to the Pakistani population while in no way infringing on the rights of resident Pakistani citizens.

The Imran Khan Administration, by contrast, is enamoured to the interests of expatriate Pakistanis in ways that even expatriate Pakistanis are not about their own interests. For instance, who in the world has left Pakistan and would like to still be able to vote in Pakistani elections? If I feel that passionately about voting in Pakistani elections (and I personally do), I can time my annual trips home to coincide with election season. But again, even expatriate voting takes away nothing from resident Pakistanis.

The Naya Pakistan Certificates do. They offer a benefit to expatriate Pakistanis – high interest rates on easily accessible certificates of deposit – that are explicitly barred to resident Pakistanis. And by the way, the taxes of those resident Pakistanis will have to pay for the interest on that exorbitant interest to the expatriate Pakistanis.

In what universe can that possibly be construed as fair?

The problem with the PTI’s stance towards expatriate Pakistanis is that they view us as somehow better than the Pakistanis who continue to live within Pakistan. There is a view, for instance, that expatriate Pakistanis are somehow patriotic towards Pakistan, or that we are more law-abiding, or that our remittances are somehow an act of love for the country.

All of those are lies that need to be systematically refuted so that this government can stop offering undeserved special privileges to expatriates at the expense of actual residents and citizens.

Barring those who left Pakistan because they were persecuted for the religious or political beliefs (a shockingly small minority of expats), the overwhelming majority of people who leave Pakistan do so for one reason above all else: money. I left Pakistan because I wanted more money and a better life than the country could offer me. That is it.

That ‘better life’ in my case also included higher education in the United States, which one supposes is a somewhat more acceptable purpose than the raw mercenary instinct of wanting more money. But make no mistake: people leave because they want more material comforts above all else.

That does not make expats bad people or any worse than any person who chooses to stay in Pakistan. But it absolutely does not make us any better, and the PTI-led government would do well not lose sight of that fact.

The patriotism of expatriates, however, is completely fake. It is a misguided manifestation of nostalgia more than anything else. Expats love not the country that is, but their memories of family and friends that they left behind. The patriotism that one sees at the events that Musharraf and Imran Khan hold abroad is more of a manifestation of the guilt we feel for having abandoned our families and friends for the material comforts we live with now, for not having done more to ensure those we left behind could have a better life.

It is guilt masquerading as patriotism, but it is not even the kind of guilt that motivates real action. It is a hollow guilt: a performance of words when one does not want to actually change any of one’s actions. The patriotism is very loud hypocrisy, and nothing more.

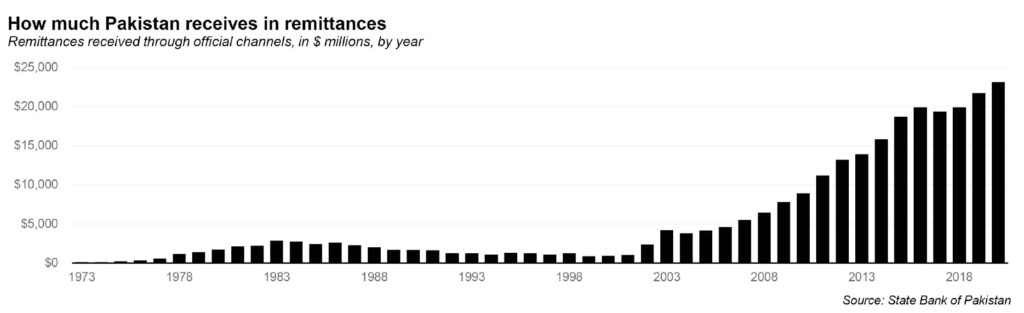

As for the money sent back as remittances, it has nothing to do with love of country at all: it is purely love of family. People support their families financially regardless of where they live. I live in Washington DC and my brother lives in Karachi. We both support our parents. I have a little more money, he has more of an ability to help with his physical presence. There is nothing more to remittances than that, at least for expats living outside the Gulf Arab states.

With the Gulf Arab states, there is definitely a different dynamic: they can never look at the country they live in as home, so they build their nest eggs in Pakistan and send money accordingly. Not all of the money is for family: some of it is their own savings. But again, the motivation is not altruistic, or patriotic at all.

We would undertake all of these actions regardless of what the government thought of us. It helps – as in the case of the Pakistan Remittance Initiative (PRI) of the State Bank of Pakistan – when the government removes barriers.

So, for instance, the Roshan Digital accounts allow expatriates to open bank accounts in Pakistan completely online, and by mail, which is remarkably helpful. But that is a privilege that is denied to resident Pakistanis, which makes the whole thing unfair: expatriates are being offered something that would benefit residents too, but only the former gets it and the latter does not.

And, of course, as we mentioned, the Naya Pakistan Certificates take that perverse logic one step further: taking tax money from the hard working, law-abiding, tax-paying residents, and giving it away to the expatriates in the form of excessively generous deposit accounts – while denying access to those accounts to the people who are ultimately paying for them.

This is wrong. Just plain wrong. There are no other words to describe it. And it must be put to an end as soon as humanly possible.

SBP responds to objections raised by ‘Profit’ to Naya Pakistan Certificates:

In response to a questionnaire sent by ‘Profit’ apropos: ‘Naya Pakistan Certificates are ridiculously attractive for investors. But here is why that is bad for Pakistan’, Chief Spokesperson, State Bank of Pakistan has issued a statement. In the interest of fair journalism, it is being reproduced here:

Why are we targeting non-residents Pakistanis?

First of all, we would encourage your readers to visit the SBP website dedicated to Roshan Digital Accounts (https://www.sbp.org.pk/RDA/index.html) to learn about all the features of these accounts.

Non-resident Pakistanis have been contributing extensively in the growth and development of the country, including by sending over USD 23 billion remittances each year. The recently launched Roshan Digital Accounts (RDAs) and Naya Pakistan Certificates (NPCs) are part of government efforts to appreciate and recognize their huge contribution of overseas Pakistanis in the country’s economy.

Specifically, RDAs provide a full spectrum of banking and investment opportunities to the overseas Pakistanis. NPCs are being offered within a wider strategic objective of integrating overseas Pakistanis with the Pakistani banking and payment system and enabling them to invest in Pakistan. This strengthening of the bond with overseas Pakistanis is likely to bring huge dividends both for the country as well as overseas Pakistanis in the medium to long term. In particular, by establishing digital banking channels and strengthening the ties with overseas Pakistanis, we will have sustained access to an additional source of foreign exchange, which so far has remained untapped.

There are several examples around the world where the sovereign has issued bonds / certificates exclusively for non-residents at attractive pricing in order to augment foreign exchange buffers. This includes for instance Bangladesh, India, Nigeria, and Sri Lanka.

Why are we not offering Naya Pakistan Certificates to residents?

Kindly note that resident Pakistani with declared assets held abroad are allowed to invest in NPC by bringing the amounts held abroad to Pakistan, as also explicitly noted on the SBP website (https://www.sbp.org.pk/RDA/index.html). The objective is to incentivize these resident Pakistanis to bring their declared foreign exchange to Pakistan. Resident Pakistanis with foreign exchange assets in Pakistan are not allowed to invest in NPCs as that will result in dollarization and will put pressure on the exchange rate.

We would also note that resident Pakistanis have multiple investment options ranging from short and long-term placements/deposits with banks at fairly attractive rates, investment in National Savings Schemes, Treasury Bills and Pakistan Investment Bonds, investment in stock market, mutual funds, property market etc. None of this was available to overseas Pakistanis despite their huge contribution in the economy. Pakistanis living abroad are earning in foreign exchange and the objective here is to offer an attractive investment alternative to NRPs so as to attract foreign exchange and build FX buffers. Similarly, the external inflows in RDAs and NPCs would also help to improve Pakistan’s balance of payment position and lessen pressure on the exchange rate. The Roshan Digital Account (RDA) channel has made some of these options available to them. This initiative is strategic in nature aimed at having long term and sustained access to an additional source of capital. The benefits of RDA in terms of improved external position will also be enjoyed by the residents.

How was the rate of return on Naya Pakistan Certificates determined?

Non-resident Pakistanis (NRPs) have access to full range of instruments issued by different sovereign governments. So the appropriate benchmark to compare pricing is the prevailing secondary market yields on the existing $ bonds issued by Pakistan in international capital markets.

In this context, the five year remaining Pakistan $ bond maturing on September 2025 is currently trading around 6.6%. The same bond was trading at 8.4% at end November 2018 and 11% at end March 2020. Sovereign yields and credit spreads of emerging market countries can be volatile. Accordingly, the yield of 7% on 5 year NPC is both appropriate and also reasonably attractive for NRPs as they choose among several alternatives available to them. If and when the credit spreads of Pakistan change in the international capital markets, the government has the option of reviewing the pricing on NPC.

How will the funds raised through Naya Pakistan Certificates be utilized and returns generated?

The funds being mobilized through NPCs will be available to the government for multiple uses including financing social and infrastructure spending and the budget deficit more generally. The budget includes a significant Public Sector Development Program (PSDP), which not only increases the productive capacity of the economy but also attracts private investment. The development of critically important communications, roads, power generation and transmission infrastructure and investment in human development envisaged in PSDP will boost our economic growth.

Mobilizing incremental financing from external sources through NRPs also helps free up domestic resources for domestic private sector to utilize, including for making investment. Specifically, with fresh funds from abroad, government financing needs from domestic resources will come down, enabling banks to extend more credit to private sector and again helping promote economic growth.

We would also note that the profit on NPCs is subject to a withholding tax of 10%.

Other specific clarifications

- Pakistan’s exchange rate regime is not the same as before. Pakistan has moved to a market-based flexible exchange rate regime since May 2019. The exchange rate has already adjusted and is now determined in the market. It has become the first line of defence against external shocks, rather than the country’s foreign exchange reserves. The previous preference for a relatively fixed exchange rate used to result in large current account deficits and a depletion of foreign exchange reserves, necessitating abrupt and large depreciations of PKR. Historical averages of exchange rate depreciation may not necessarily be a good indicator for the future trend in the exchange rate.

- Early encashment does entail costs to the customer. The NPC encashed prematurely will earn the return applicable on nearest shorter completed tenor. Further, no return is admissible if an NPC is encashed prior to 3 months, the shortest tenor. For instance, if an NPC of 12 months tenor is encashed after 9 months, it will earn the rate applicable on 6 months NPCs, thus penalty is inbuilt into the pricing structure.

- NPCs are not more liquid than normal bonds. It is incorrect to assume that NPCs are more liquid than normal tradeable bonds, as in the absence of a secondary market, the investor has the only choice to return the bond to the issuer. Although SBP has made arrangements to redeem the NPCs within 48 hours, however, it still entails a penal clause.

Dear Mr. Farooq,

I read your articles keenly. But this article lacks some enthusiasm.

Being an investor, non-resident Pakistani would invest some where else if not in Pakistan. Secondly, you have not considered one of the biggest benefits of such investments from non-resident Pakistanis versus a local investor deposit. A deposit by expat brings money, which would not relate to our economy. This money in turn flourishes different sectors of economy. Consider your own article, that you wrote few months ago regarding people only investing in real-estate. Now expat has an alternate option to invest in Pakistan.

Thank you,

Shafique

If a local depos

For your information Mr. Farooq

These expatriate Pakistanis are the one who send 24 billion dollars annually and whole of Pakistanis inside Pakistan manage to earn even lesser dollars by exports. Also remember that expats pay taxes in the countries where they live and also manage to support Pakistan economy. So once in 70 years a Government is supporting them, we all should appreciate this.

Non sense article. People in Pakistan have lucrative investment opportunities in national savings schemes which give good profit. These certificates are a means to attract foreign exchange which every government needs. What a lame and pessimistic comparison.

Emotions over objectivity.

This is such a ridiculous article making comparisons with US issued Bills and rates on offer. A simple investment strategy which can be understood by a lame person is Higher the risks, Higher the rewards. Pakistan’s country rating is so low by a reputable credit agency ie Moodys, Fitch and S&P so you would not expect rates on offer to be in line with Bonds issued by US government, hence very attractive returns on offer in particular for PKR investments.

Your article sells the NPC very well and many expats will be attracted now … however you did not cover the tax aspect Of just 10 percent tax whereas same investment by resident Pakistanis will attract 15 percent tax ….on NPC as well as bank deposits profit on debt category

Hey now, one of the rare time, ABSbpP comes up with a creative market strategy and you are busting their bubble. Keep.it shush.

NRP’s was looking to participate in back home economics. This Government working on rite directions. They are thinking for both side benefit.

We like to part of Pakistan no matter where we live.

Thanks Pakistan

Dear Mr.Tirmizi

Just to clear the resident Pakistani with declared assets can also invest on NPC and in ur article you only ranted about this being unfair for resident Pakistanis.

after reading ur article im starting to feel you are a mutamain PATWARI !!

GRAPE !!!

Dear Author, you had me until you called OPs’ patriotism fake. Most of us left to pursue better economic opportunities for our families and it was no fun establishing ourselves abroad. Your compass is completely OFF on that one.

The writer of the article is absolutely correct. The SBP should offer the same rates to Resident Pakistanis who had dollars in their Pakistan bank accounts. This will erase the SBP argument that dollarization of the economy will occur as new dollars cannot be utilized for this purpose.

Listen F, speak for yourself, and not anyone else, OK. Many Pakistanis have gone abroad and there children have done things that go well beyond money, read about the NHS, the olympic medals overseas Pakistanis have won, the number of sitting MP’s of Pakistani descent within the house of commons, and more. Why doesn’t F go talk about the qadiani movement and it’s absurd mandatory chanda taxes? Talk about that. Any member of the qadiani movement with naya pakistan certificates would be forced to concede their share to the Masroori cult through mandatory and forcible chanda. But nooooooo, you can’t speak ill of the qadiani mafia or kashif the clown and his allies in the pseudo-liberal, pseudo-intellectual movement of dramaybaaz wannabe Westerners will claim you’re calling for outright…you know what. Funny that many of the same dramaybaaz pseudo-liberals are now supporting Nawaz, his daughter, and their son in law, who they also accused of you know what.

The author clearly has no clue about credit risk, liquidity or dollarization of an economy nor does he understand why every country tries to invite foreign investment. It would be futile to try to teach him economic theory. As to comments about patriotism of expats, he is probably projecting his own feelings and are not necessarily applicable to vast majority of expats.

Bhai baat yeh hai k jo log bahir hain unko yehin mind mn hota hai k kuch time lga k wo pak wapis ayen or jo paisay unhone bchye us se pak mn hin akay koi business kr lain.

This guy lives in US, I doubt he intent to come back

I think between the objections the author and clarifications of SBP these certificates aren’t a particularly bad idea. Although I concur the rates are a tad too high, considering the interest is also payable in US$, original deposit and the earnings both are eligible for repatriation out of country. I recommended these to my brother just today. Question is also how the government is going to earn sufficient return on the borrowings?

Your point about motivation of remittances are spot on, nobody or at least very few send these bucks because they are grateful to Pakistan, it is either need or desire for gain that motivates home remittances.

ANOTHER FAKE SITE SUPPORTING INDIAN NARRATIVE?

This article was so well written (NOT) that after reading it, I made sure that I open an account and I did so. 😉

Stupidity at its best. If non-resident Pakistanis do not have an option to invest in Pakistan, they will do so somewhere else. It may be unfair deal to Pakistani residents but why criticise the whole scheme?

You do not become Financial Times just by copying their website. This piece is prime example of that 🙂

This Author is a completely irrational and more emotional than logical.. He sits in Washington with probably a US Green card and call more than 4 millions NRPs living in the Gulf unpatriotic who have no where to go but Pakistan once there Job is finished.

We didn’t come here for more money , we came here because there isn’t a better opportunity available in Pakistan. and believe me everyone who comes here, his/her goal/ambition is to earn enough to go back to Pakistan and start his own business. we do not come here for any Green Card. I would be happy to work for far less in Pakistan than what I earn here.